Industrial employment strong despite supply chain headwinds

Our review of employment data over the course of the pandemic creates an interesting picture of the industrial asset sector and its resilience through nearly 18 months of global business disruption and overall market volatility. This employment data shows that transportation, warehousing, and construction are outperforming all other commercial real estate sectors and they are poised to recapture the brief declines that occurred early in the pandemic. In this issue we look at what is ahead on the employment front, including how demand for workers is creating challenges for the industrial asset class and may cause future impacts for industrial investors.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

Emerging from a volatile spring in 2020, the U.S. industrial sector has seen steady and continued employment recovery and production growth throughout the pandemic, as online shopping surged and many manufacturing and related businesses benefitted from their essential service designation. This has fueled 2020-21 leasing velocity and demand for warehouse and logistics space, as supply chain strategies have adapted and evolved, first from reactionary moves to longer-term strategies. Nearly 18 months into the pandemic and at a time when e-commerce continues to expand and capture new consumers, the industrial sector, from transportation and warehousing through construction and mining, is outpacing all other commercial real estate sectors in employment.

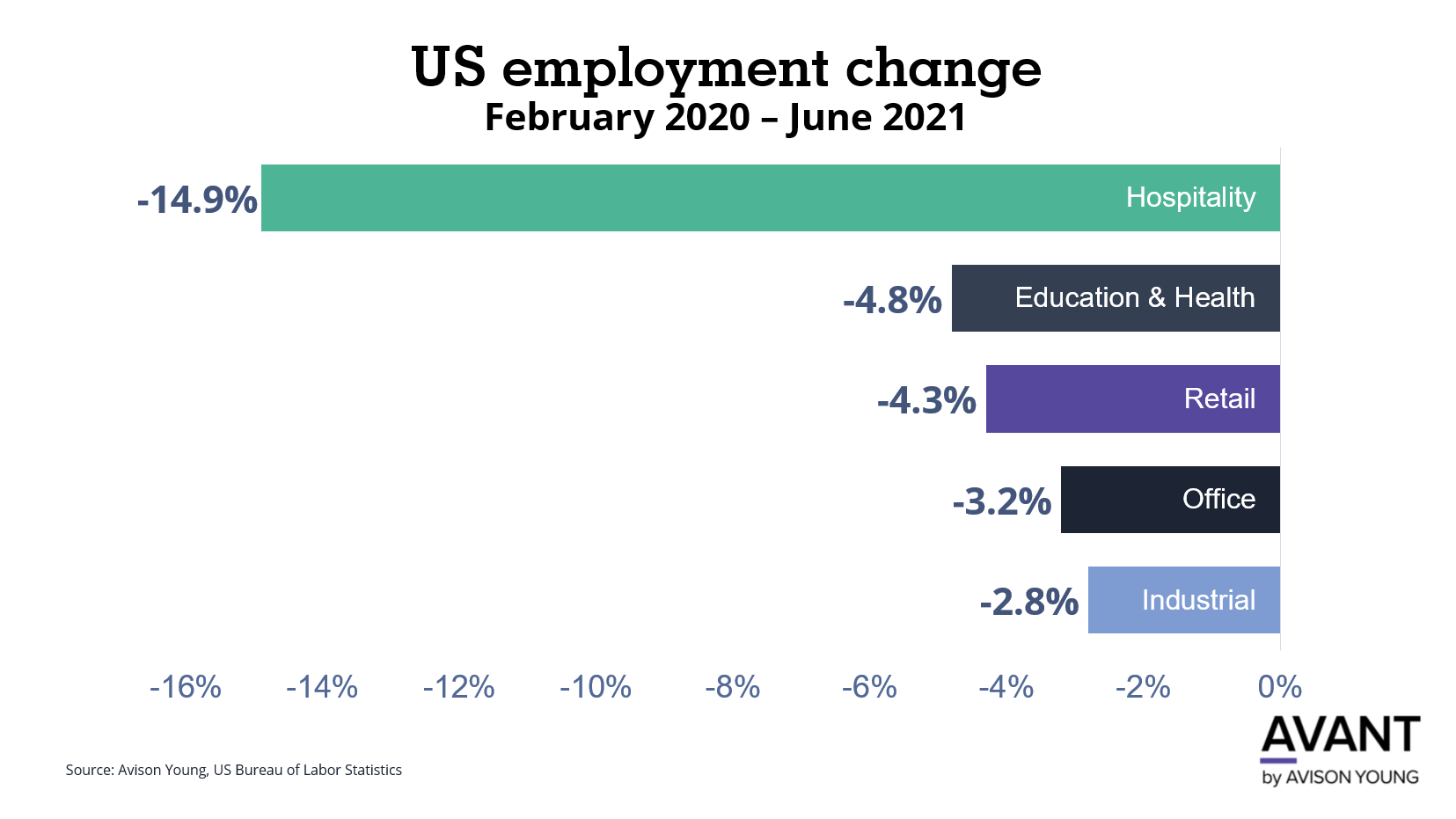

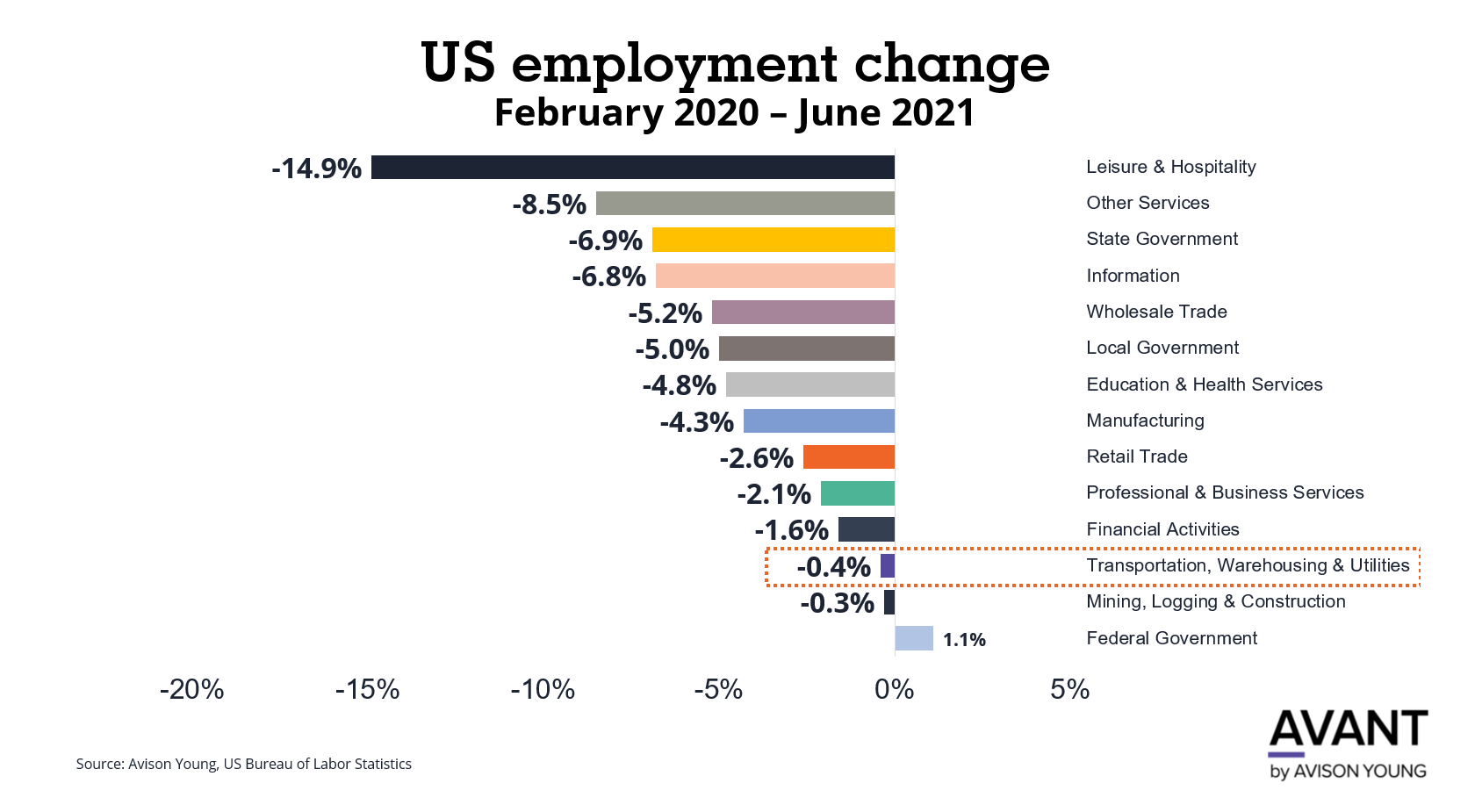

While industrial employment dipped in the early days of the pandemic, the sector has recouped much of those losses. The resilience of the industrial market has faired much better than the hospitality, retail and other asset classes that suffered significant employment losses and continue to search for a stable footing.

The US Employment Trends dashboard, driven by AVANT by Avison Young, shows that overall U.S. industrial sector employment, as of May 2021, totaled 18.1 million, a 4.2% increase over the past 12 months. A look at select markets showed that many markets are near their February 2020 levels, having recouped the jobs that went into steep decline when the disparate effects of the pandemic fully manifested themselves. New York had 1.42 million industrial workers in May 2021, a decrease from 1.56 million in February of 2020, but a notable gain from the April 2020 low point of 1.21 million. Los Angeles had 1.23 million, down from 1.3 million in February 2020. Chicago had 1.06 million, down from 1.07 million in February 2020. Since the beginning of the pandemic, the industrial sector has performed relatively better than other asset types, recovering many of its short-term job losses.

The U.S. industrial employment figures show a 0.4% decrease in the transportation and warehousing sector and a 4.3% decrease in the manufacturing sector from February 2020 to June 2021. The data indicates that the job market for the industrial sector is faring much better than other sectors.

Hospitality and retail properties were among the hardest hit during the early days of the pandemic and are still navigating uneven business and consumer spending and travel cycles. And, the office sector continues to grapple with significant declines in space utilization as businesses weigh their return-to-the-office plans.

The hospitality sector has seen a 48% drop in employment since February 2020, but posted a sizable gain in June 2021, adding 343,000 jobs as the reopening of restaurants, stores and meeting spaces continued across the country. As would be expected, job recovery has been slower in markets that are dependent on tourism and the quickest in large metros that reopened more quickly.

The COVID-19 boost for manufacturing, logistics, warehouse and related businesses has been well documented, but is important to note in examining the employment picture. As many brick and mortar retail businesses struggle to recover and face ongoing challenges, the industrial market has benefitted considerably from the shift to online ordering, curbside pickup and related changes to consumer buying habits. Some of the labor that shifted away from non-essential retail to warehouse and transportation in 2020 is also expected to remain in those sectors permanently.

Backlogs continue to stress supply chain

The overall performance of the industrial sector may be faring well, but it is important to recognize the factors that are impacting employment and overall production. Supply chain backlogs, including shortages in the computer chips used to run high-tech equipment, have begun to affect the manufacturing sector.

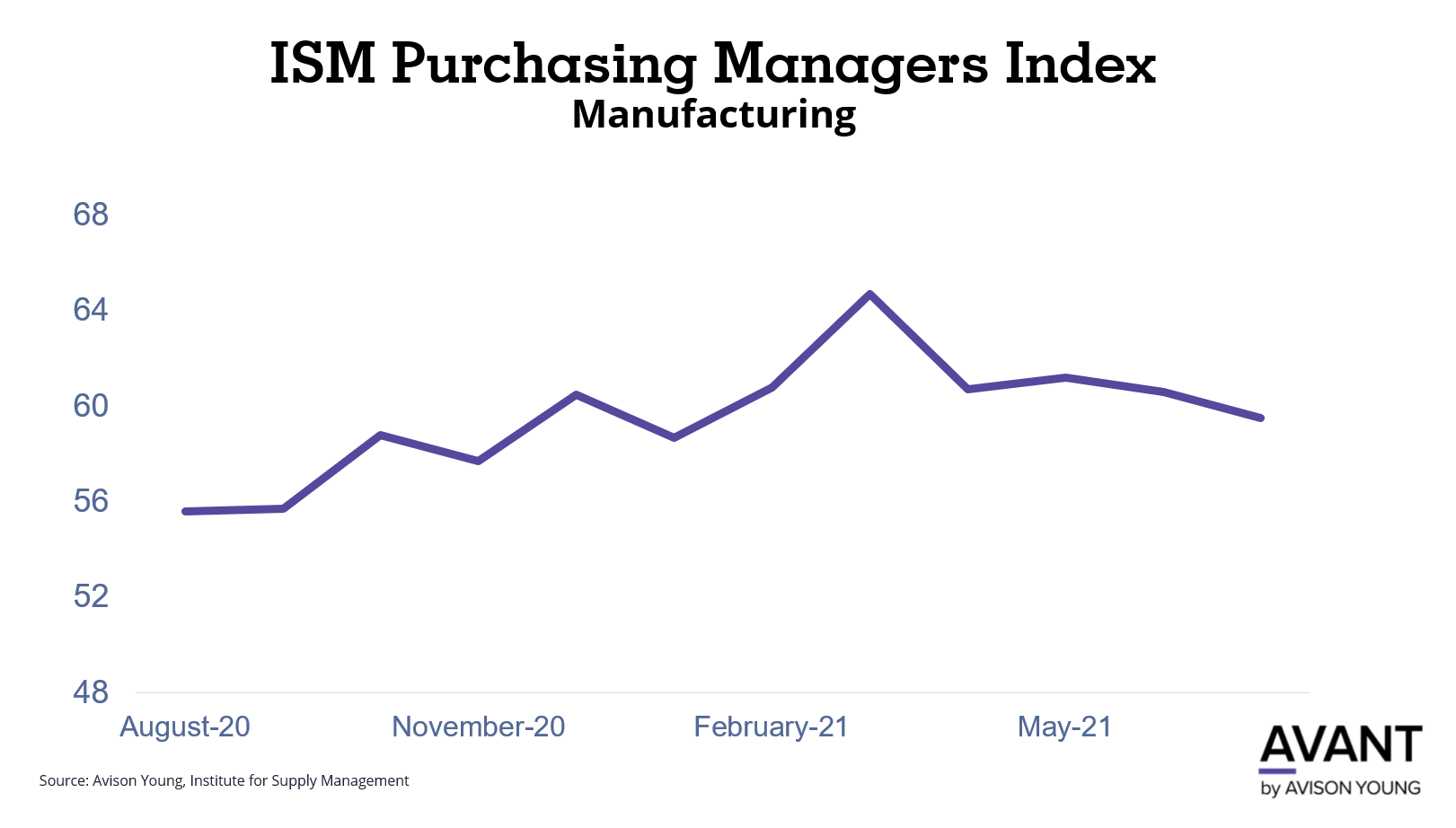

According to the Institute for Supply Management, July 2021 was the 14th consecutive month of manufacturing growth, although activity declined slightly from a level of 60.6 in May to 59.5 in July. (An ISM measurement above 50 indicates growth in the sector). Machinery, computer and electronic products and other industries showed growth in July, with only textile mills seeing a decline, according to the ISM index.

Rising commodity prices and the increased lead time needed for procuring raw materials are other factors impacting this sector, but are showing signs of moderating. The ISM survey's measure of prices paid by manufacturers fell to a reading of 85.7 in July from a record 92.1 in June, reflecting an easing in commodity prices. The drop is the largest decline in the index since March 2020 and supports the mindset that inflation will moderate as supply constraints decline.

Although the industrial sector as a whole has a healthy job outlook, there is currently a worker shortage facing the areas of warehouse and transportation. A June 2021 Bureau of Labor Statistics report shows that employment in transportation and material moving occupations increased year-over-year by 14 percent -- from 9.9 million to 11.3 million. While the outlook for industrial employment remains strong, these labor issues, coupled with the scarcity of goods and parts are expected to moderate growth in the sector.

Sources: Associated Press, AVANT dashboard analytics, Bureau of Labor Statistics, GlobeSt., Logistics Viewpoints, Reuters

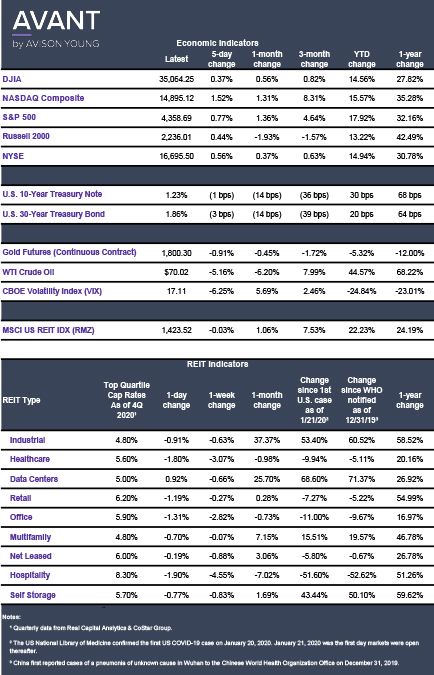

Click the image for Economic Indicators

Erik Foster, Principal

Head of Industrial Capital Markets

312.273.9486

[email protected]